Malaysia does not. Claims for capital allowance can be made in.

Capital Allowance In Nigeria Bomes Resources Consulting Brc

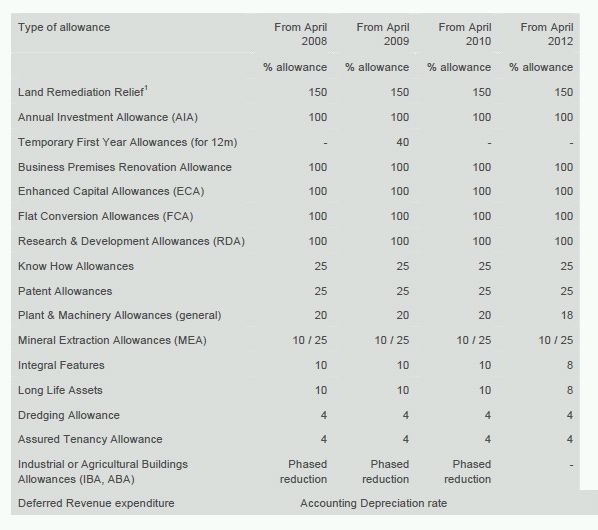

There are many types of allowances which.

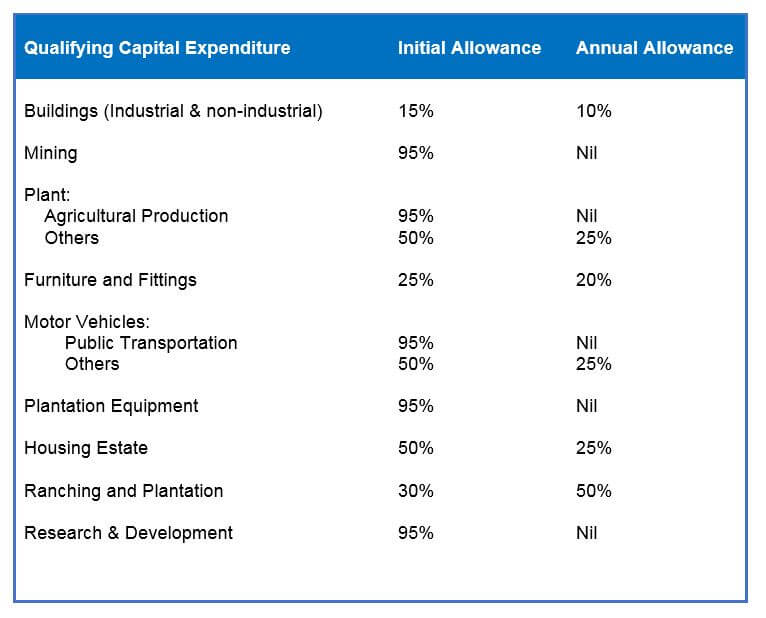

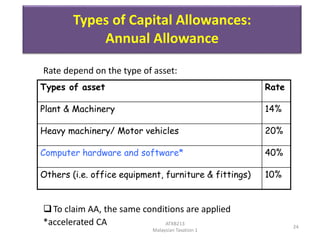

. The person who has the right to claim capital allowance is the person who has expended on the purchase or acquisition of the said asset. While annual allowance is a flat rate given every year based on the original cost of the asset. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

22 The provisions of the Income Tax Act 1967 ITA related to this PR are. We hope more HR people will get more insight about planning the best allowance-scheme. The purpose of claiming capital allowances.

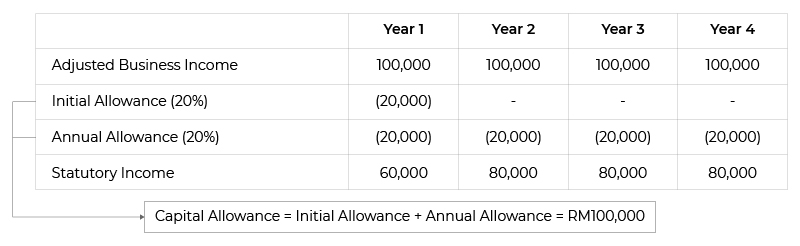

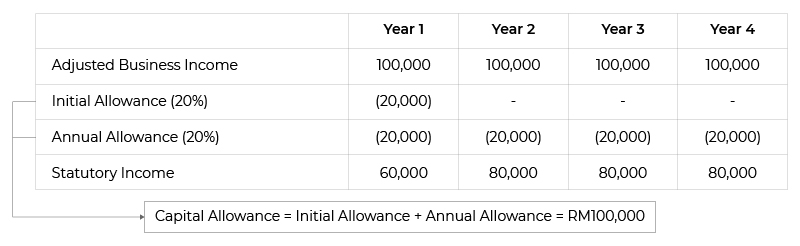

Initial allowance IA NGN 1000000 NGN 25 NGN 250000 NGN 112500 is the annual allowance AA for NGN 1000000 250000. Income Tax Accelerated Capital Allowance Information and Communication Technology Equipment Rules 2008 PUA 3582008. The annual allowance is given for each year until the capital expenditure has been fully written off unless.

Companies can claim capital allowances on most asset purchases that are for. Often overlooked are proper claims of capital allowances on plant and machinery present in a building structure such as fire alarm and. Wear and tear allowances claims for qualifying plant and machinery PM claimed at 125 over 8 years.

In general capital gains in the country are not subject to income tax. And 9 August 2012 Income Tax Accelerated Capital Allowance Plant and Machinery Rules 2009 PUA 1112009. Corporate - Tax credits and incentives.

In addition to the initial allowance there is an annual allowance for capital. Industrial buildings allowances claims typically claimed at 4. Tax depreciationcapital allowances claims.

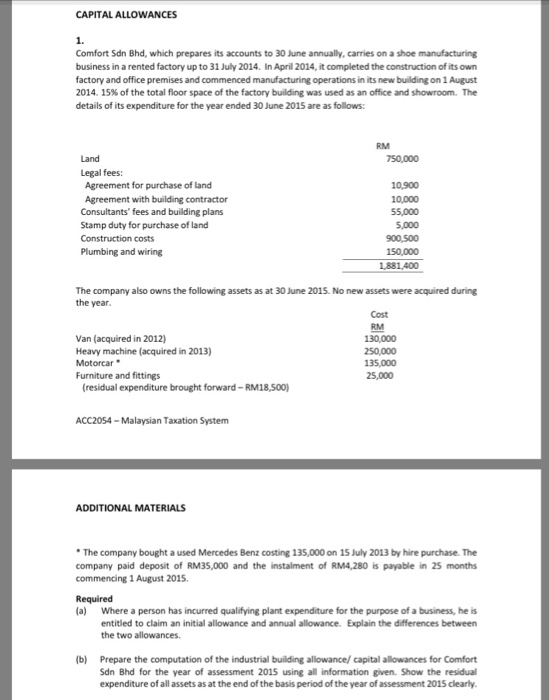

Capital allowance is intended to alleviate this. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business. The RPGT will be levied on your chargeable gains.

Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed as tax deductions. Tax incentives can be granted through income exemption or by way of allowances. In addition to the initial allowance there is an annual allowance for capital.

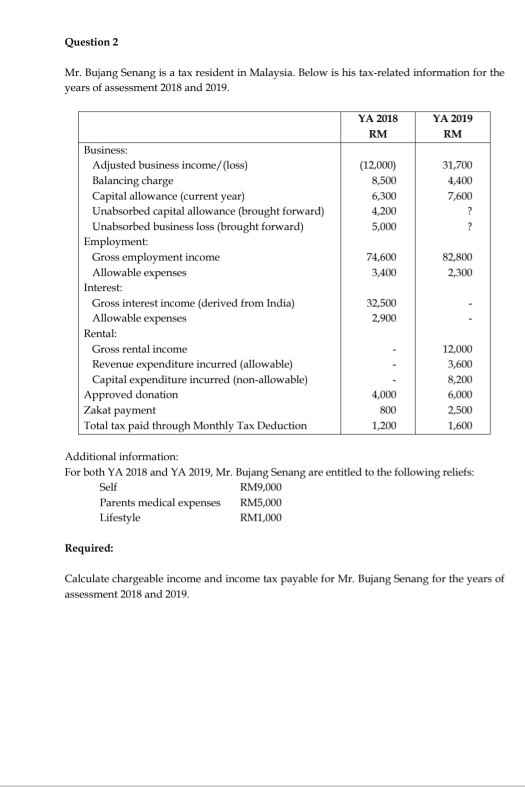

Where incentives are given by way of allowances any unutilised allowances may be carried forward indefinitely to. One of these deductions is the capital allowances in Malaysia. What you would need to pay is the real property gains tax RPGT.

What Is Capital Allowance Computation. Fixed assets in a business are worn and rusted over time. Many taxpayers are unaware that this form of tax deduction could lead to their companys efficient tax management.

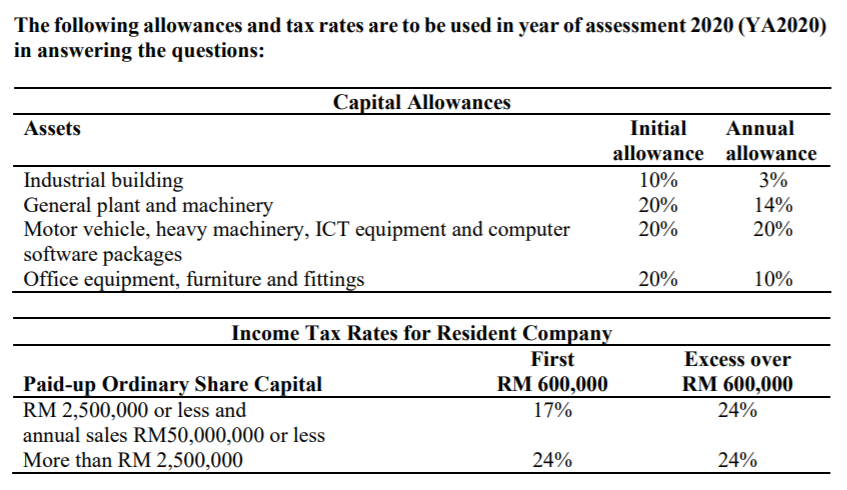

In this article Seekers will share a review of 3 types of allowances with reference from the Inland Revenue Board of Malaysia LHDN tax ruling and how the allowances affect the tax payment. Plant and machinery analysis for RD tax credit claims. In the 2020 Economic Stimulus Package announced on 27 February 2020 it was proposed that accelerated capital allowance ACA made up of 20 initial allowance and 40 annual allowance be given on qualifying capital expenditure on machinery and equipment including information and.

Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. This leaves us with a. Malaysia has a wide variety of incentives covering the major industry sectors.

We have extensive experience of preparing the following claims. YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions as a place. 64 A person is deemed to have elected for special allowances on small value assets if he computes the allowance for small value assets using the special allowances rate under paragraph 19A of Schedule 3 of the ITA in his tax computation.

Qualifying expenditure QE QE includes. Accelerated capital allowance ACA for the purchase of machinery and equipment. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

Examples of assets that are used in business are motor vehicles machines office equipments furniture etc. Last reviewed - 14 December 2021. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses.

Fixed assets in a business are worn and rusted over time. And b computation of capital allowances for expenditure on plant and machinery. Claim capital allowances under paragraphs 10 and 15 of Schedule 3 of the ITA in respect of the said assets.

Capital Allowances study is important to ensure the amount of claims is made correctly. Capital Allowance for Leasing Asset. A The eligibility of incentives under the PIA 1986 re-investment allowance.

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and Free Zones Act 1990. A capital allowance is the amount of expenditure that a UK business may claim against its taxable profit under the Capital Allowances Act and is regulated by HM Revenue and. 72018 Date Of Publication.

In Malaysia any sale made from your investments is not subject to the capital gains tax. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule. Tax Leader PwC Malaysia 60 3 2173 1469.

Unabsorbed capital allowances incurred during the pioneer period can be carried forward and deducted from the post pioneer income of the company. Capital allowance is only given to business activity. Your capital assets are also not subject to this tax system.

What Is Capital Allowance In Malaysia. A capital allowance equal to the amount of expenditure for small-value assets that each cost up to 2000 Malaysian ringgits MYR where the total capital expenditure of such assets generally does not exceed MYR20000 the limit of MYR20000 does not apply to small and medium-sized enterprises SMEs effective YA 2020. A lease is a contract where a party is the owner lessor of an asset leased the asset to the lessee at a consideration rental either fixed or variable for a certain period and at the end of such period the asset subject to the embedded options of the lease will either be returned to the lessor or sell to the lessee at an agreed price.

Capital allowance is intended to alleviate this. At the time when capital expenditures are incurred an initial allowance of. Capital allowances in Malaysia are therefore deductible expenses.

Capital Allowance Calculation Malaysia With Examples Sql Account

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Capital Allowances1 Pdf Claiming Capital Allowances A Schedule 2 Capital Allowance Schedule Must Be Completed And Attached To The Taxpayer Yearly Course Hero

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Tax Planning For Business Assets The Star

Net Energy Metering Schemes Solar Sunyield

Capital Allowances Recent Changes To Rates Thresholds Etc Tax Authorities Uk

Malaysian Companies Solar Tax Incentives By Helmi Medium

Chapter 7 Capital Allowances Students

Malaysian Companies Solar Tax Incentives By Helmi Medium

Solved Capital Allowances 1 Comfort Sdn Bhd Which Prepares Chegg Com

Superior Taxcomp Import Capital Allowance From Excel File Youtube

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

F6 P6 Capital Allowances Youtube

Malaysia Taxation Junior Diary Capital Allowance Schedulers